Trend Breaking Level (TBL)¶

for TradingView

deScription¶

For what?

- Smart trailing stop. Timely identification of a trend change, i.e. the dominant market participant (seller/buyer), is essential for implementing a "smart" trailing stop of an open position. Don't forget: it's easier to get in than to get out!

- Entry points. The indicator can be used to search for potential entry points when the trend changes, but with great caution, as the end of one trend is not always the beginning of another.

Warning: using this indicator to search for entry points is suitable only for very experienced traders. See examples of using the indicator.

What does it show?

First and foremost, the main indicators element is:

the Trend Breaking Level (TBL). It's a step line that runs through price action and shows a dominant directional trend, i.s. the nearest:

the Trend Breaking Level (TBL). It's a step line that runs through price action and shows a dominant directional trend, i.s. the nearest: support during an uptrend (trail stop for long);

support during an uptrend (trail stop for long); resistance during an downtrend (trail stop for short).

resistance during an downtrend (trail stop for short).

The main events of the indicator - marking exit points from a position. Their are displayed as two types of labels:

«Take profit» - partial closure due to a weakening trend;

«Take profit» - partial closure due to a weakening trend;

«End of trend» - complete closure due to a trailing stop (when the market crosses the current TBL).

«End of trend» - complete closure due to a trailing stop (when the market crosses the current TBL).

The indicator also highlights the background of the chart in trend "zones":

.

.

How it works?

Using volume analysis of the market, the script identifies "key" price levels, which when broken have the highest probability of cancelling the current trend.

This levels have different "strengths" and are ranked by the script algorithms, allowing not only the main TBL to be highlighted, but also additional ones for intermediate take profits for open positions.

Getting started¶

When adding the indicator to the chart, you need to select the start time (candle) of the calculation by clicking on the chart:

After that, a dialog box will appear to confirm the selected time, as well as a request to enter the verification code:

After confirming the entered data, the indicator is added to the chart and ready to work:

Please note:

- Information about the subscription expiration date is displayed in the upper right corner.

- The start time of the script calculation is marked with a vertical line and the label "Begin".

- The screenshot above shows the first of the basic style presets for the indicator's appearance.

TIP: The "Begin" line can be moved by dragging it with the mouse on the chart at any time. The indicator will be recalculated from the new calculation "point".

Indicator Settings¶

Begin Time¶

Setting the initial "point" of the indicator calculation - i.e. the date and time from which the indicator will be plotted on the chart. The start can be set in two ways:

- Selecting the desired date and time using the drop-down calendar.

- Moving the vertical line with the label "Begin" on the chart with the mouse.

NOTE: Changing the start point will cause the indicator to be completely recalculated and repainting.

Verification Code (for demo)¶

In this field, you need to enter the activation code of the indicator. The prefix of the code contains the expiration date of the subscription. For example, a code of the form 05_30_XXXXXX will be valid until noon on the 30th day of May.

NOTE: The subscription expiration time is marked on the chart with a red vertical line and the label "End":

Style presets¶

For convenience, you can quickly change the visual design of the indicator without visiting the Style tab. There are three "basic" presets to choose from, each showing a different approach to working with the indicator:

First

Second

Third

NOTE: In the Style tab, you can still manually customize the drawing appearance of the indicator!

Offset¶

An additional offset (in ticks) of TBL to "expand" buy/sell trend zones. This is useful, for example, when working with instruments during low volatility.

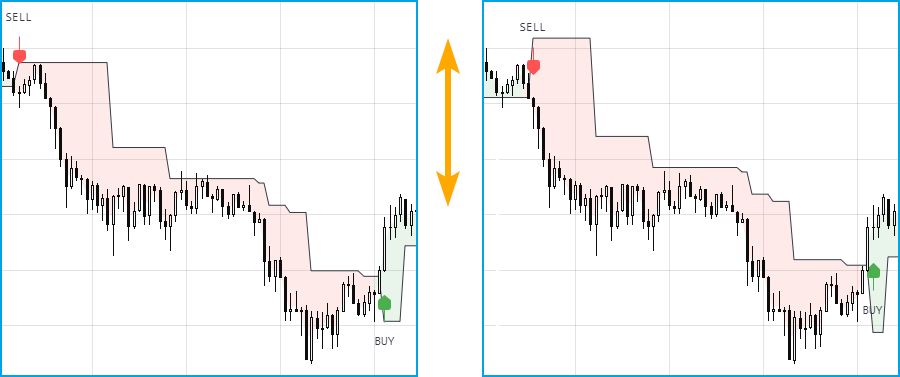

On the left - offset by 10 ticks, on the right - by 30:

NOTE: The offset size is given as an example. The actual offset value depends on your trading strategy.

Widest initial Level¶

If you enable the "Widest initial level" switch, the initial stop level after a trend reversal will be only from local extremums (pivot points).

With the disabled switch (basic mode): indicator choosing initial stop level between extremums and "key" levels automatically.

On the left - basic mode, on the right - option is enabled:

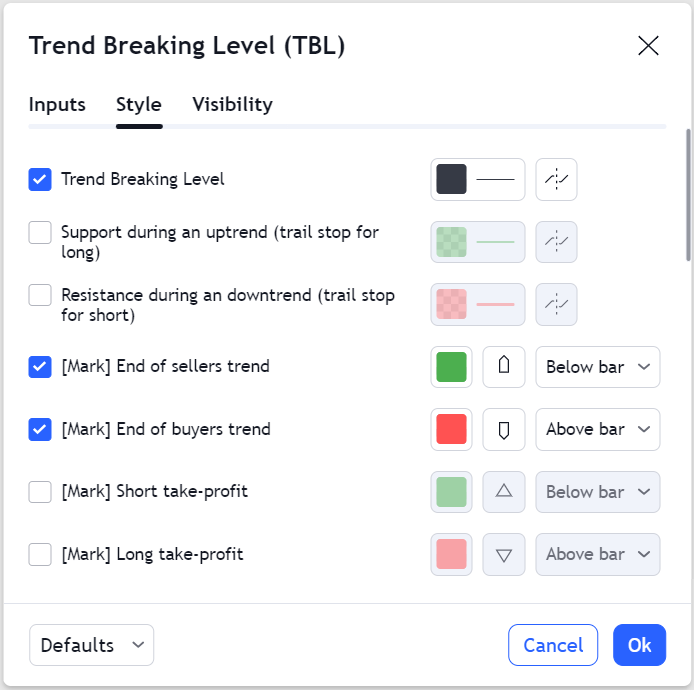

"Style" Tab¶

In this tab, you can flexibly adjust the visual design of the indicator (lines, labels, background color, etc.) in a familiar way.

Alerts¶

The indicator generates individual alerts for six events:

|

«1. End of sellers trend» Crossing the resistance level by price action. Full closure of the shorts is recommended. |

|

«2. End of buyers trend» Crossing the support level by price action. Full closure of the longs is recommended. |

|

«3. Reduce SHORT during the downtrend» Partial reduction (take-profit) of shorts due to sellers trend weakening. |

|

«4. Reduce LONG during the uptrend» Partial reduction (take-profit) of longs due to buyers trend weakening. |

|

«5. Update the support level» Step-by-step updating (shifting) of the support level during the uptrend. It's a trailing of stop when you are in long position. |

|

«6. Update the resistance level» Step-by-step updating (shifting) of the resistance level during the downtrend. It's a trailing of stop when you are in short position. |

Subscription¶

Get a monthly subscription for $150 and use the indicator of your dream...

Demo access¶

To get demo access, follow the link.

Disclaimer¶

Prior to using any trading software, you should consult with a financial professional. Please carefully consider whether such trading is suitable for you in light of your financial situation, and whether you are able to assume financial risks. Under no circumstances are we responsible for any losses or damages incurred by you or anyone else as a result of any trading or investment activity that you or anyone else engages in, based on any information or materials obtained through the use of our services or this website.